The insurance industry has a “dirty secret” about the hidden cost of fully insured plans that many employers are unaware of – health insurance companies prefer fully insured plans because they’re more profitable for them, but often far less beneficial for employers.

While insurance companies enjoy larger margins, employers find themselves paying higher premiums, with little control over their healthcare spend.

Don’t know the difference between fully and self-funding and why self-funding is usually better for employers? No worries, we’ll explain below.

In this article, these topics will be discussed:

- Why fully insured plans benefit insurance companies but usually put employers at a disadvantage;

- The financial and medical advantages of self-funded and level-funded plans;

- How self-funded and level-funded plans provide businesses with greater control and potential for savings;

- Understanding the differences between these plan types to help employers make more informed decisions about managing healthcare costs and improving employee health outcomes.

What is a fully insured health plan?

A fully insured health plan is a traditional model where the health insurance company assumes the financial risk for providing healthcare coverage to employees.

In this arrangement, employers pay a fixed premium to the insurance company every month, which covers the cost of their employees’ healthcare needs.

The premium amount is determined based on the number of employees and estimated healthcare costs for the group. However, if the actual healthcare costs incurred by employees are lower than the premium paid, the insurance company keeps the difference as profit.

In 2022, the average annual premium for employer-sponsored family health insurance coverage was $22,463, with employees contributing $6,106 toward that amount.¹ Fully insured plans tend to cost 10% to 15% more than self-funded plans, as employers are locked into a fixed premium regardless of how much or how little healthcare services are used.

For insurance companies, this model is highly profitable. They take on minimal risk while retaining any unspent premiums, allowing them to collect significantly more than the actual cost of claims. This creates a financial incentive for insurance companies to promote fully insured plans to employers, as it maximizes their margins.

What is a self-funded health plan?

In a self-funded health plan, the employer takes on the financial risk for providing healthcare benefits to their employees. Instead of paying a fixed premium to an insurance company, the employer directly funds the healthcare claims as they arise. To protect against unusually high costs, many self-funded employers use stop-loss insurance, which covers catastrophic claims that exceed a predetermined threshold.

Self-funding offers several financial advantages. On average, employers who self-fund their healthcare plans experience 15% lower overall healthcare spending compared to fully insured plans.

One key factor behind this savings is the ability to use a Pharmacy Benefit Manager (PBM), reducing margins that would otherwise go to the insurance carrier. This allows employers to have more control over their pharmacy benefits and optimize costs.

In addition to financial benefits, self-funded plans provide medical advantages. Employers gain access to detailed claims data, enabling them to target healthcare interventions where they are most needed. For example, early detection and direct contracting for musculoskeletal (MSK) conditions, cancer treatments, and metabolic syndrome can lead to better outcomes and lower costs. According to the National Business Group on Health, self-funded employers can realize 30-40% savings over five years by using these targeted healthcare strategies.²

However, self-funded plans do come with challenges. Despite the use of stop-loss insurance, employers may still face fluctuations in healthcare expenses from year to year, which can make budgeting more complex.

Nonetheless, for many employers, the potential cost savings and greater control over healthcare decisions outweigh the risks associated with self-funding.

What is a level-funded health plan?

A level-funded plan is a hybrid approach that combines elements of both fully insured and self-funded plans. It is designed to provide employers with more budget certainty while offering the potential for cost savings typically associated with self-funding.

In this model, employers pay a fixed monthly amount to cover their employees’ healthcare claims, similar to a fully insured plan. However, unlike fully insured plans, if the total healthcare claims are lower than expected, employers receive a refund or credit at the end of the year.

Level-funded plans offer several key benefits. First, they provide stability with predictable monthly payments, allowing employers to budget more effectively. This makes level-funded plans particularly attractive to small to mid-sized companies that want the financial predictability of a fully insured plan but the potential cost savings of a self-funded plan.

With the added possibility of receiving money back if claims are low, level-funded plans can be a cost-effective solution for companies looking to manage healthcare expenses more efficiently.

According to recent data, approximately 20% of employers with fewer than 500 employees are now utilizing level-funded plans.³ This trend reflects the growing appeal of these plans for companies seeking a balance between financial stability and potential savings.

The DIRTY SECRET of the insurance industry

One of the lesser-known truths in the insurance world is that insurance companies often make significantly more money from fully insured plans than they do from self and level-funded options. This financial incentive explains why many insurers push fully insured plans despite the fact that they may not be the most cost-effective option for employers.

Fully insured plans benefit health insurance companies in several ways. First, these plans come with higher premiums, which guarantees a steady and predictable revenue stream for the insurer. Since the insurance company takes on the risk, they charge premiums that are often inflated to cover potential claims, even if those claims never occur. This setup minimizes risk for the insurer while maximizing their profits.

Additionally, in fully insured plans, insurance companies retain any unspent premiums. At the end of the year, if the total cost of claims is lower than expected, the insurance company keeps the excess funds, further increasing their profitability. Employers, on the other hand, see no return on the premiums they’ve paid, regardless of the level of healthcare utilization.

Finally, fully insured plans often limit or complete remove employers’ access to claims data, making it difficult for businesses to make informed decisions about their employees’ healthcare needs. Without detailed claims data, employers lose the ability to implement targeted interventions or cost-saving measures, leaving them reliant on the insurer’s decisions. This lack of transparency favors insurance companies, keeping employers in the dark while ensuring the insurance companies maintain control over the data and profits.

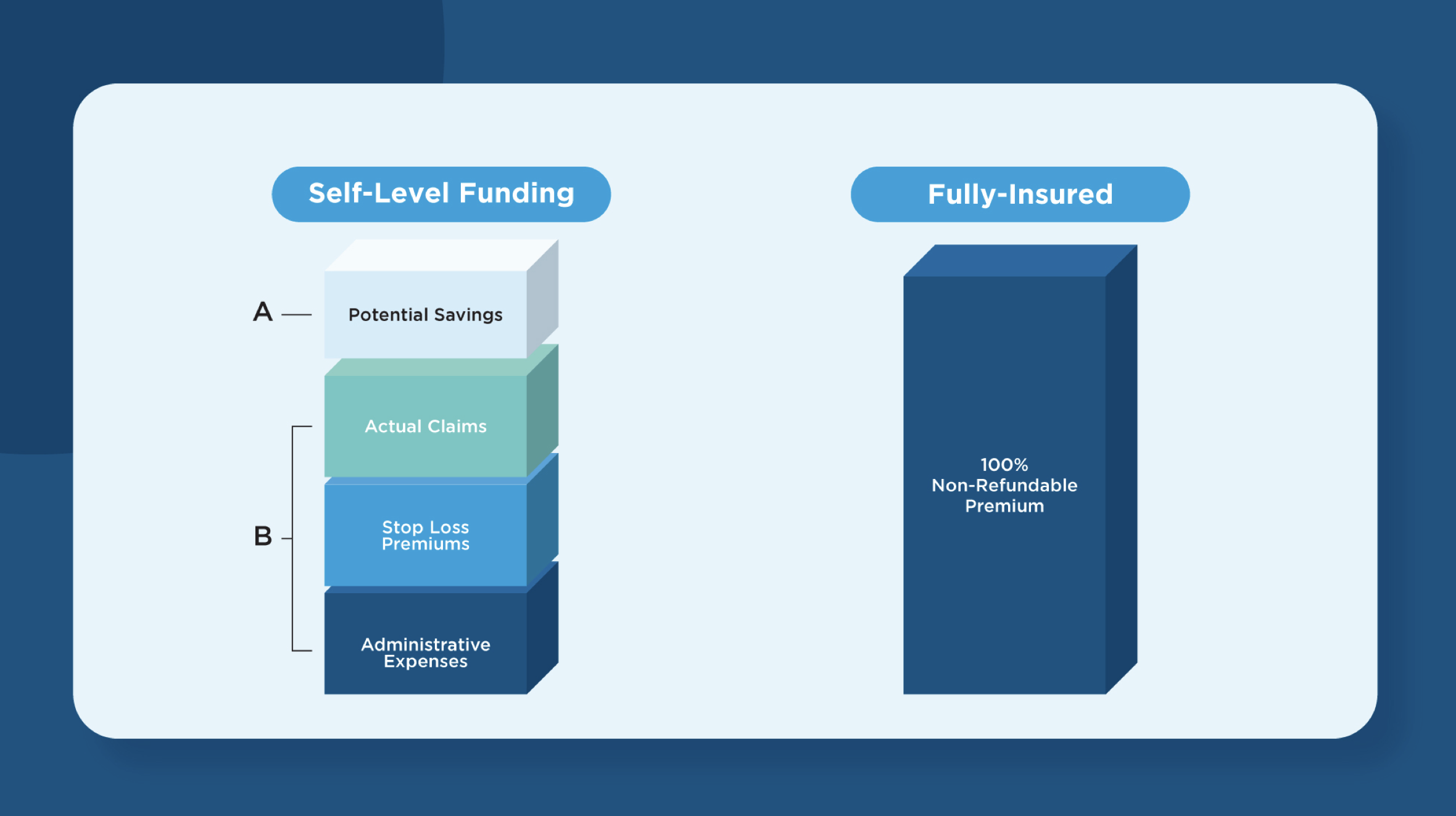

Self-Funding vs. Fully Insured – The financial comparison

When comparing self-funding to fully insured plans, the financial advantages for employers in self-funding are clear. Employers who choose self-funding typically see 15-20% savings on healthcare premiums compared to fully insured plans.

This is partly due to the flexibility self-funded plans offer, such as the ability to control the selection of a Pharmacy Benefit Manager (PBM), which can further reduce costs. Additionally, self-funding allows for greater flexibility in plan design, enabling employers to tailor benefits to meet the specific needs of their workforce.

On the other hand, fully insured plans come with higher fixed premiums, and there is no opportunity for refunds or savings if claims are lower than expected.

Why self or level-funding might be ideal for you

Self-funding presents the greatest opportunity for savings, particularly for small to mid-sized employers. These companies can benefit from the flexibility and cost control that self-funding offers, often resulting in lower employee out-of-pocket costs over time—in some cases, up to 30% lower than fully insured plans. This long-term reduction in expenses helps businesses better manage healthcare costs while providing more comprehensive benefits to employees.

Self-funded plans have proven successful across a variety of industries, from tech to manufacturing, demonstrating their versatility.

The growing popularity of self-funding in different geographic areas, combined with increasing industry success stories, shows how social proof is encouraging more businesses to adopt this model. Employers looking for sustainable ways to manage healthcare expenses and improve employee satisfaction are increasingly turning to self-funding as the ideal solution.

Conclusion

In summary, self and level-funding offers significant advantages over fully insured plans, providing better financial and medical performance for employers. While fully insured plans primarily benefit insurance companies through higher premiums and retained profits, self-funding empowers employers with more control over their healthcare spending and the flexibility to tailor plans to their employees’ specific needs.

For employers and brokers seeking to maximize savings and enhance healthcare outcomes, self-funding or level-funding is the ideal path forward. Partnering with the right Pharmacy Benefit Manager (PBM) is crucial to realizing these benefits. Intercept Rx is the best PBM for self and level-funded companies, offering tailored solutions that help reduce costs and improve efficiency.

Visit Intercept Rx to explore how much your company could be saving by partnering with us. Discover the transformative power of our Rx Optimization Program and take the first step toward a smarter, more cost-effective healthcare strategy.