In today’s healthcare landscape, managing pharmacy spend has become a critical concern for employers and employees. With prescription drug costs steadily rising, the impact on company budgets and individual out-of-pocket expenses cannot be overstated.

As these costs continue to climb, employers are looking for effective strategies to optimize their pharmacy benefits and control expenditures.

This is where Pharmacy Benefit Managers (PBMs) like Intercept Rx play a crucial role. PBMs have the expertise to navigate the complex world of drug pricing, formulary management, and rebate structures, offering tailored solutions that can significantly reduce costs.

In this article, we will explore the key challenges associated with pharmacy spending, including rising drug prices, the lack of transparency in traditional PBM models, and the complexities of managing benefits. We will then discuss effective solutions that brokers should present to their clients, such as transparent PBM services and Rx Optimization Programs. Finally, we will outline strategies for brokers to gain more clients by highlighting transparency, showcasing proven results, and leveraging technology to provide detailed insights into pharmacy spend.

By understanding these critical components, brokers can position themselves as valuable partners in managing pharmacy benefits and driving cost savings for their clients.

Understanding Pharmacy Spend Challenges and Solutions

Rising Costs

One of the primary challenges in managing pharmacy spend today is the continuous increase in prescription drug prices. In 2022, the U.S. saw its prescription drug spending reach $576.9 billion, marking a significant 7.4% rise from the previous year, according to IQVIA.¹ Prices are still on the rise to this day. This increase is largely driven by the introduction of costly specialty medications and ongoing price hikes for existing drugs.

These rising costs affect both employers, who face higher healthcare plan expenses, and employees, who may have to deal with higher out-of-pocket costs. Such financial pressures require effective strategies to manage and optimize pharmacy spending.

Lack of Transparency

Traditional PBMs often operate with opaque pricing and rebate structures, which can obscure the true cost of medications. This lack of transparency means employers and employees might not see the full benefits of negotiated discounts, leading to higher-than-expected costs.

Without clear visibility into the pricing models and rebate flows, it becomes difficult for organizations to make informed decisions about their pharmacy benefits.

Complexity in Benefits Management

Navigating the complexities of pharmacy benefits is a significant challenge for brokers and employers. Understanding drug formularies, managing different pricing tiers, and staying updated with new drug approvals are all demanding tasks.

Effective management requires a deep knowledge of these factors to avoid overspending and ensure that employees have access to the medications they need. The complexity of these systems can lead to inefficiencies and additional costs if not managed correctly.

By acknowledging these issues—rising costs, lack of transparency, and the inherent complexity of benefits management—brokers and employers can take proactive steps to better manage pharmacy spend, ensuring sustainable and cost-effective healthcare benefits.

Solutions brokers should present to their clients

Transparent PBM Services

One of the most effective ways to manage pharmacy spend is through transparent Pharmacy Benefit Manager (PBM) services. Transparency in PBM operations means providing clear and straightforward pricing models and ensuring that any negotiated discounts or rebates are fully passed on to employers and employees.

This approach not only helps to control costs but also builds trust between the PBM, brokers, and clients. Intercept Rx, for example, is committed to transparency, offering straightforward pricing and clear rebate structures.

By choosing transparent PBMs, brokers can ensure their clients are not caught off guard by hidden fees or unexpected costs, making the pharmacy benefit plan more predictable and manageable.

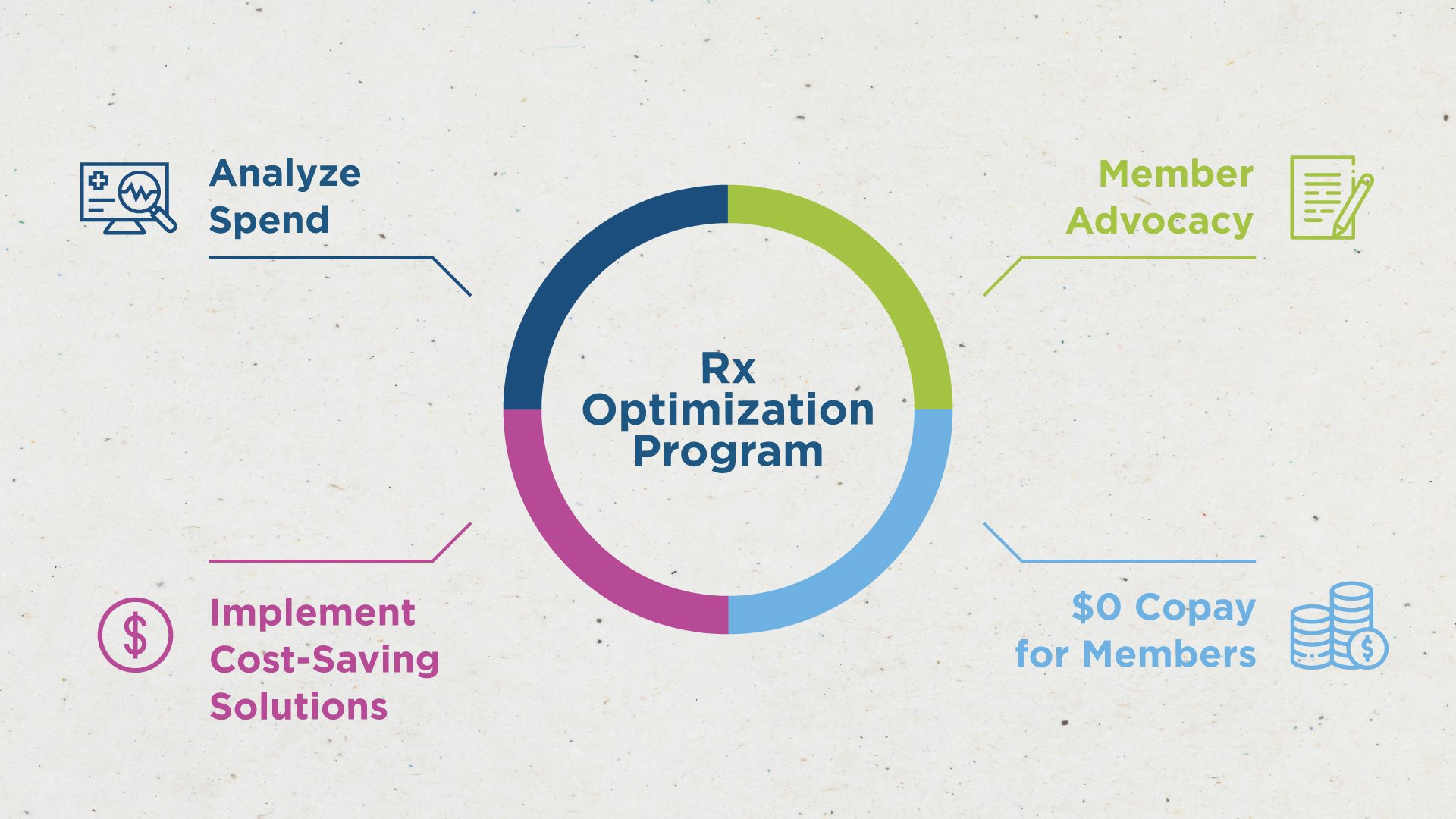

Rx Optimization Programs

Implementing an Rx Optimization Program is another crucial solution for controlling pharmacy costs. These programs focus on using data analytics and best practices to optimize drug utilization, ensuring that patients receive the most effective medications at the best possible price.

By analyzing prescribing patterns, evaluating alternative therapies, and negotiating better prices for high-use drugs, Rx Optimization Programs can significantly reduce unnecessary spending.

For instance, a client who implemented an the Intercept Rx, Rx Optimization Program could see an average reduction of 30% in their pharmacy spend by promoting cost-effective drug sources. Brokers should highlight these programs to their clients as a practical way to achieve substantial savings.

Key information brokers should be telling their clients

Cost-Saving Opportunities

One of the most crucial pieces of information brokers should communicate to their clients is the potential for cost savings when the right Pharmacy Benefit Manager (PBM) and Rx programs are implemented.

By selecting a PBM that prioritizes transparency and offers comprehensive Rx Optimization Programs, clients should achieve significant reductions in their pharmacy spend. Highlighting specific examples of cost-saving opportunities—such as leveraging mail-order services, or utilizing formulary management—can help clients understand the tangible benefits of working with a knowledgeable broker and a forward-thinking PBM. These strategies can not only reduce costs but also maintain or improve the quality of care provided to employees.

Compliance and Regulation Updates

The healthcare industry is constantly evolving with new regulations and compliance requirements frequently being introduced. Brokers must keep their clients informed about these changes, particularly those that directly impact pharmacy benefits. Whether it’s updates to federal drug pricing regulations, changes in rebate requirements, or new compliance mandates for prescription drug plans, staying informed is essential.

By proactively knowing and sharing this information, brokers can help clients avoid compliance pitfalls, adapt to new regulatory landscapes, and ensure that their pharmacy benefits programs are not only cost-effective but also compliant with the latest laws.

The Competitive Edge

In the competitive world of employee benefits, staying ahead of the curve is vital. Brokers should emphasize the importance of being aware of the latest trends and innovations in pharmacy benefits.

According to a report by the National Association of Health Underwriters, 68% of companies are more likely to switch to a broker who offers cutting-edge solutions in pharmacy management.

This statistic underscores the need for brokers to continuously update their knowledge and services. By offering advanced solutions like data analytics for monitoring drug utilization, implementing an Rx Optimization Program, and partnering with the right PBM, brokers can differentiate themselves from the competition and provide unmatched value to their clients.

By focusing on these key areas—cost-saving opportunities, compliance and regulation updates, and staying competitive—brokers can equip their clients with the knowledge and tools needed to manage their pharmacy spend effectively. This approach not only strengthens the broker-client relationship but also enhances the overall value of the services provided, ensuring long-term success in managing healthcare benefits.

Conclusion

Effectively managing pharmacy spend is essential to control healthcare costs and maintain the quality of benefits provided to employees. With rising prescription drug prices and the complexity of benefits management, it’s crucial to adopt strategies that provide clarity and cost control.

Transparent Pharmacy Benefit Managers (PBMs), such as Intercept Rx, offer a clear path to cost savings through straightforward pricing and rebate structures. Additionally, an Rx Optimization Program ensures that members have access to the most cost-effective medications, further driving down costs.

Brokers play a critical role in this process. By staying informed about industry trends and actively promoting innovative solutions, brokers can help their clients achieve significant savings and optimize their pharmacy benefits. This proactive approach not only helps clients manage their pharmacy spend but also positions brokers as trusted advisors in the ever-evolving healthcare landscape.