A 2025 employer’s guide to finding a transparent PBM that reduces costs and improves employee health and satisfaction.

Key Takeaways:

- Not all PBMs are created equal. Choosing the right one requires evaluating transparency, customization, and technology-driven solutions.

- Employee needs should drive your PBM strategy. 78% of employees say health benefits influence their decision to stay with a company.

- Transparent, pass-through PBMs can deliver big savings. Employers can reduce pharmacy spend by up to 25% with smarter, optimized solutions.

- Member-focused services matter. Programs like $0 copays, home delivery, and member advocacy improve satisfaction and adherence.

A PBM should be a strategic partner. Intercept Rx stands out by offering personalized service, data insights, and long-term plan optimization.

The PBM market in 2025: Why choosing the right Pharmacy Benefit Manager matters

Prescription drug costs are rising fast. In 2023, U.S. spending on prescription drugs hit $405 billion, and it’s projected to surpass $600 billion by 2027, according to the latest estimates from the Centers for Medicare & Medicaid Services (CMS) and IQVIA.¹ For employers, this presents an urgent challenge: how to manage pharmacy benefits in a way that balances rising costs with the growing needs of employees.

That’s where Pharmacy Benefit Managers (PBMs) come in. PBMs are third-party administrators that help employers manage prescription drug benefits by negotiating with drug manufacturers, managing formularies, and processing claims. But not all PBMs are created equal.

Traditionally, many PBMs have operated in opaque ways offering little transparency into how drug prices are set or how rebates are handled. This lack of clarity has led some employers to feel they have little control over one of the largest line items in their benefits budget.

Today, a new model is emerging: Pharmacy Benefit Solutions. These modern PBMs go beyond administration. They offer data-driven tools, transparent pricing models, and member-first programs designed to align with a company’s strategic goals like cost reduction, employee satisfaction, and smarter healthcare outcomes.

This article provides guidance on how to choose the best PBM for a company in 2025. The one that can help control pharmacy spend, keep employees healthy and engaged, and deliver real value every step of the way.

Align your pharmacy benefits with company goals and employee expectations

Before selecting a Pharmacy Benefit Manager, it’s essential for employers to clearly define their goals and assess the specific needs of their workforce.

Choosing the right PBM isn’t just about cutting costs, it’s about finding a long-term partner that supports the company’s broader health and business strategy.

Some key questions to ask during this evaluation process include:

- Are you primarily focused on lowering overall healthcare costs?

- Is employee satisfaction, engagement, or talent retention a top priority?

- Do you need greater control and transparency over your pharmacy benefit spend?

Each company’s needs are unique, but understanding these priorities upfront can help narrow down PBM options that align with the right capabilities and values.

Health benefits, particularly pharmacy coverage, play a critical role in workforce retention. According to a survey, 78% of employees say health benefits influence their decision to remain with an employer.² That means pharmacy benefits are more than just a cost center, they’re a powerful tool for building loyalty, improving morale, and supporting employee well-being.

As pharmacy costs rise and employee expectations evolve, selecting a PBM that aligns with both financial goals and workforce needs is more important than ever.

What to look for in a PBM: Transparency, customization, and data-driven tools

Not all Pharmacy Benefit Managers operate the same way and selecting the right one can make a significant impact on both cost savings and employee satisfaction. As employers evaluate PBM options, several key factors should guide the decision-making process:

- Transparency: Does the PBM provide full visibility into pricing, rebate structures, and fees? Lack of transparency is a common frustration. Only 28% of employers report being “very satisfied” with their PBM’s transparency.³

- Customization: Can the PBM tailor solutions to fit your company’s structure, whether you’re self-funded, level-funded, or require unique plan features?

- Formulary Control: Will you have a say in which medications are included or excluded? Flexibility in formulary design can reduce waste and improve outcomes.

- Reporting & Analytics: Are there tools available to help track savings, utilization trends, and opportunities for improvement?

- Technology: Is the PBM leveraging modern technology to streamline processes and improve results?

These factors are essential in determining whether a PBM is equipped to deliver real, measurable value. A solution that is opaque, rigid, or outdated could lead to higher costs and less control over the health benefits strategy.

For example, customizable pharmacy benefit solutions—like those offered by Intercept Rx give employers the ability to adjust coverage based on workforce needs while maintaining full visibility into where every dollar goes.

👉 Learn more: How Intercept Rx Helps Brokers Deliver Cost-Saving Customizable Pharmacy Benefit Solutions

Member-focused PBMs: Why the employee experience should

come first

While cost savings are essential, employers should also consider how a PBM supports the employees who use the pharmacy benefit every day. A truly effective PBM doesn’t just manage claims, it enhances the member experience.

When evaluating PBMs, look for features that reflect a member-first approach, such as:

- A dedicated member advocacy program to help employees navigate coverage, appeal denials, or find affordable alternatives.

- Access to $0 copay options or affordable generics that make necessary medications more accessible.

- Free home delivery services to improve convenience and adherence.

- Responsive, high-quality customer support that’s easy for members to access when they need it most.

These features can make a significant difference. Companies that prioritize member experience often see a return in the form of reduced absenteeism, better medication adherence, and higher employee satisfaction.

Choosing a PBM with member-focused services signals to your workforce that their health and convenience are a priority not just a line item in a budget.

👉 Learn more: How Intercept Rx Delivers Exceptional PBM Customer Service

Compare cost-saving Pharmacy Benefit Programs: How pass-through PBMs and Rx Optimization reduce spend

Cost control remains a top reason employers evaluate or switch PBMs but it’s not just about negotiating better prices. The true savings often come from the PBM’s structure, approach, and transparency.

Here’s what to look for when comparing PBM cost-saving programs:

- Rebate Pass-Throughs: Does the PBM pass 100% of manufacturer rebates back to the employer? Many traditional PBMs retain a portion of these rebates, which can drive up costs and reduce trust.

- Alternative Pricing Models: Transparent, pass-through pricing gives employers complete visibility into where every dollar is going—unlike traditional spread pricing models, where PBMs profit from the gap between what they charge and what they pay pharmacies.

- Rx Optimization Programs: These programs go beyond the basics. Intercept Rx, for example, offers an Rx Optimization Program that actively identifies the lowest-cost therapeutic alternatives, minimizes waste, and ensures the most clinically effective drugs are prioritized. This program not only improves clinical outcomes but also maximizes savings without compromising care.

According to Intercept Rx’s comparison with competitors, companies that switch from traditional PBMs to a pass-through, optimization-focused solution often see double-digit percentage reductions in pharmacy spend. The approach isn’t just about offering cheaper drugs, it’s about building a smarter, more strategic way to manage pharmacy benefits across the entire population.

When choosing a PBM, ask how they define value and how their programs are designed to help you reach your financial goals without sacrificing employee health.

Reducing employee out-of-pocket costs through smarter PBM strategies

While overall plan savings are important, employers should also evaluate how a PBM influences what employees pay at the pharmacy counter. Out-of-pocket costs are one of the biggest barriers to medication adherence—and they directly affect employee satisfaction, health outcomes, and productivity.

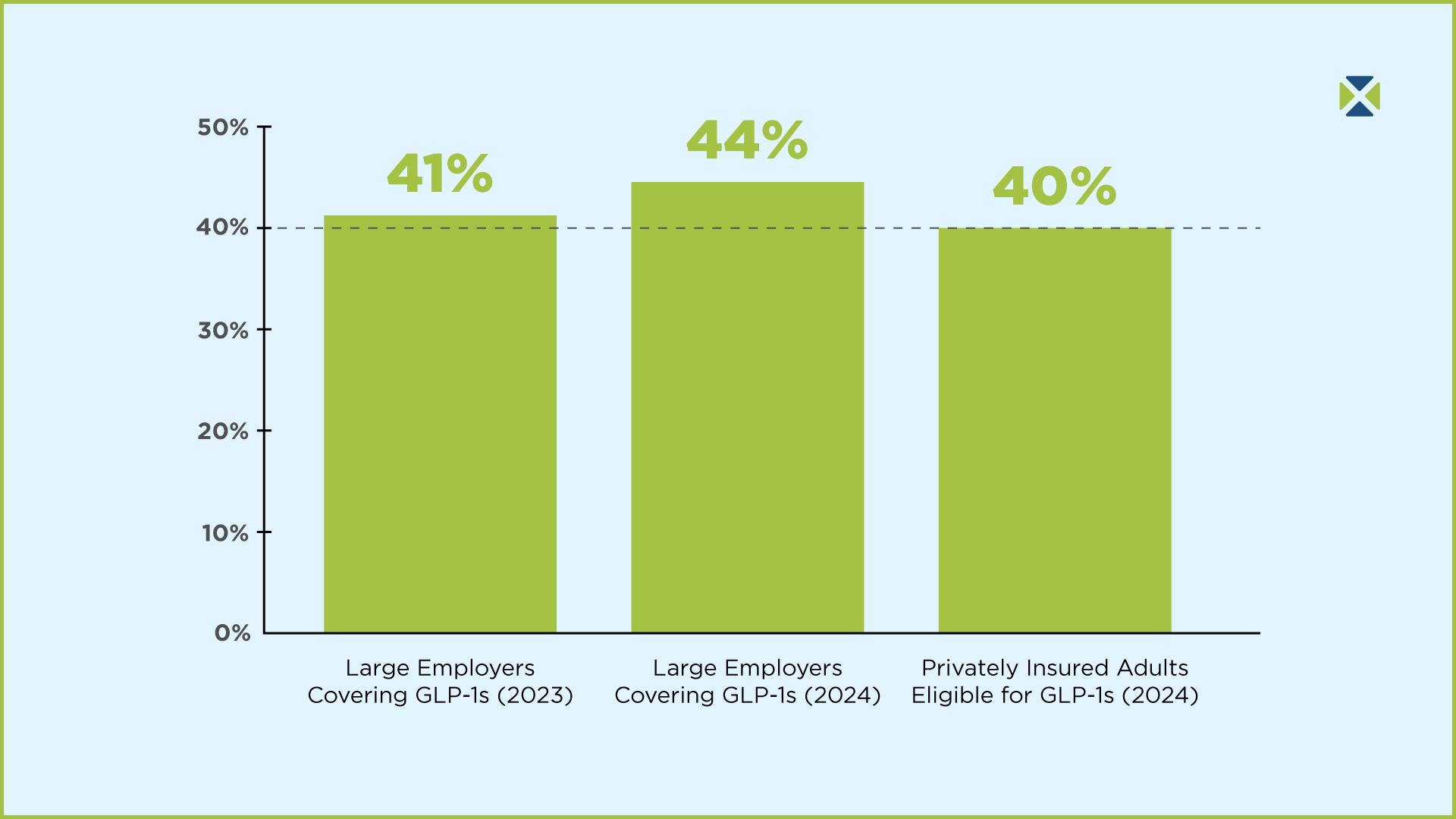

Did you know that about 40% of patients don’t pick up their prescriptions due to high out-of-pocket costs?⁴ When employees skip essential medications, it can lead to more serious health issues down the road, ultimately increasing total healthcare spend for employers.

When choosing a PBM, ask:

- Does the PBM offer programs that reduce or eliminate out-of-pocket expenses for employees?

- Are there strategies in place to eliminate low-value or overpriced drugs from the formulary?

- Can employees easily access generic alternatives or cost-saving tools?

- Are medications being chosen based on clinical effectiveness and affordability?

Intercept Rx addresses this challenge head-on. Through its Rx Optimization Program and personalized member support, the company helps reduce waste and ensures members receive affordable medications. In fact, Intercept Rx helps lower out-of-pocket costs by focusing on clinically effective therapies and negotiating the best possible pricing across every therapeutic category.

By lowering employee pharmacy expenses, employers can foster a healthier, more satisfied workforce and reduce the risk of long-term, preventable medical claims.

👉 Explore more: How Intercept Rx Lowers Out-of-Pocket Prescription Costs for Employees

A strategic PBM partnership: What it means and why it matters in 2025

Choosing a PBM should be about more than cost and coverage it should be about partnership. Employers need a Pharmacy Benefit Manager that doesn’t just provide a service, but actively collaborates to solve problems, innovate, and support long-term goals.

Here are a few signs you’re working with a PBM that acts like a true partner:

- They collaborate closely with your HR team and benefits broker, ensuring your pharmacy plan is aligned with broader company objectives.

- They provide proactive recommendations and identify areas of improvement rather than waiting for issues to arise.

- They adapt their strategies as your workforce evolves, whether that means scaling benefits, shifting formularies, or integrating new technology.

- They offer personalized support, ensuring both employers and employees feel heard, supported, and informed.

Traditional PBMs often operate with a “set it and forget it” mentality but that’s no longer acceptable in today’s fast-changing healthcare environment. Employers need flexible partners who are committed to continuous improvement.

Intercept Rx stands out in this regard. With a focus on transparency, service, and results, Intercept Rx works side-by-side with its clients to ensure the pharmacy benefit plan evolves with the company—not against it. The team prioritizes long-term relationships, measurable outcomes, and a member-first approach that builds trust.

👉 Read more: Why Intercept Rx Stands Out in the PBM Industry

Final thoughts: Choose a Pharmacy Benefit Manager that delivers results

As pharmacy costs continue to rise and employee expectations evolve, choosing the right PBM has never been more important. The best Pharmacy Benefit Manager for your company in 2025 won’t just offer discounts it will provide a comprehensive, strategic solution that aligns with your cost-saving goals and supports employee health.

Employers should look for a PBM that:

- Offers transparent, pass-through pricing and full rebate visibility,

- Provides customized benefit solutions for self-funded and level-funded plans,

- Prioritizes member satisfaction with advocacy, affordability, and access,

- Uses advanced tools and analytics to optimize pharmacy spend, and

- Acts as a true partner in improving plan performance over time.

Intercept Rx delivers on all these fronts offering a modern approach to pharmacy benefits through its industry-leading Rx Optimization Program and commitment to results-driven, member-first solutions.

💡 Ready to rethink your PBM strategy?

Get a free savings analysis to see how much your company could save by partnering with Intercept Rx and offering pharmacy benefits that truly make a difference.